The Hedera Guardian Project is a modern, open-source, auditable, and traceable carbon offset registry and accounting system. It leverages the Hedera public distributed ledger network to mint emissions and carbon offset tokens.

The Guardian is a blockchain-based platform to track greenhouse gas credits, wallets, and carbon offsets. The platform allows for the repurposing of funds from financial transactions based on environmental impact to support projects aiming to lower emissions or offset their carbon footprint.

The Hedera Carbon Market provides a programmable, verified, and auditable environment that can validate the lifecycle of carbon offset tokens while allowing the transferability of network-based emissions. It is built on top of Ethereum technology.

There is an underlying problem

The general ledger keeps track of the financial assets and liabilities of a company. Modern accounting and financial reporting are based on bookkeeping, which was invented in 1494 by Luca Pacioli.

Humankind faces a similar accounting challenge in the form of climate change on a much larger scale today. It is necessary to coordinate efforts around the world in order to solve these challenges. Globally accessible and auditable public ledgers must house our Planet’s balance sheet.

Climate or natural asset ledgers must also account for CO2, Greenhouse Gases (GHG), and other natural resources.

Typically, a climate asset represents a reduction in carbon dioxide emissions or an avoidance of them. There are standards in these assets, such as Verra REDD+, Gold Standard, and I-REC.

Climate assets today lack much information regarding provenance and chain of trust, despite their tremendous growth. It is impossible to verify this information as a buyer or auditor, even when it exists. Another recurring problem is double counting, in which the same ecological activity is used to justify the creation of multiple assets.

In the atmosphere, a liability or debit is a mtCO2e emission. A Greenhouse Gas Protocol specifies how an organization must allocate and reconcile GHG emissions across different scopes, often linked to a product or organizational standard.

It has become increasingly important for organizations to disclose their emissions in order to avoid the risk of greenwashing and comply with regulations. Cases like Ryanair and the Volkswagen Dieselgate serve as warnings to the entire business community.

Data without verifiability exposes all parties to reputational risks due to errors or tampering. It is unacceptable for any organization to accept that.

Assets that are tokenized

Distributed Ledger Technology (DLT) is used to overcome many of the difficulties associated with today’s ESG assets. To make assets verifiable and linked to their origin, they utilize DLT’s unique immutability, cryptography, and timestamping capabilities.

In addition to integrating with any other system of records, ServiceNow manages data generated by devices (e.g., sensors, solar panels, satellites), and data inputted manually (which is still common in ESG reporting). It is easy to work with digitized Measurement, Reporting, and Verification (dMRV) with ServiceNow.

Furthermore, the ServiceNow ESG Public Ledger tracks all audit logs and orchestrates token-related activities in a verifiable manner. A distributed ledger keeps track of events such as credentials delegation, information assertion, and asset transfers.

A vast number of participants make up an ESG business network. In order for the ledger to function, its onboarding and lifecycle workflows are essential. The following are some of the primary roles:

- Ecological projects are supply-side projects that tokenize CO2 reduction or avoidance.

- Almost any company willing to offset its emissions is a buyer on the demand side.

- A registry oversees the ecosystem and allows tokens to be created (e.g., Verra, Gold Standard).

- Using dMRV data or onsite inspections, a validation and verification body audits ecological project claims.

- Through a price discovery mechanism, a marketplace or exchange matches demand and supply.

- Intermediaries provide services like financing, portfolio management, custody, and reporting to buyers and sellers.

An in-depth description of ESG token taxonomy can be found in the document “Voluntary Ecological Markets Overview” by the InterWork Alliance.

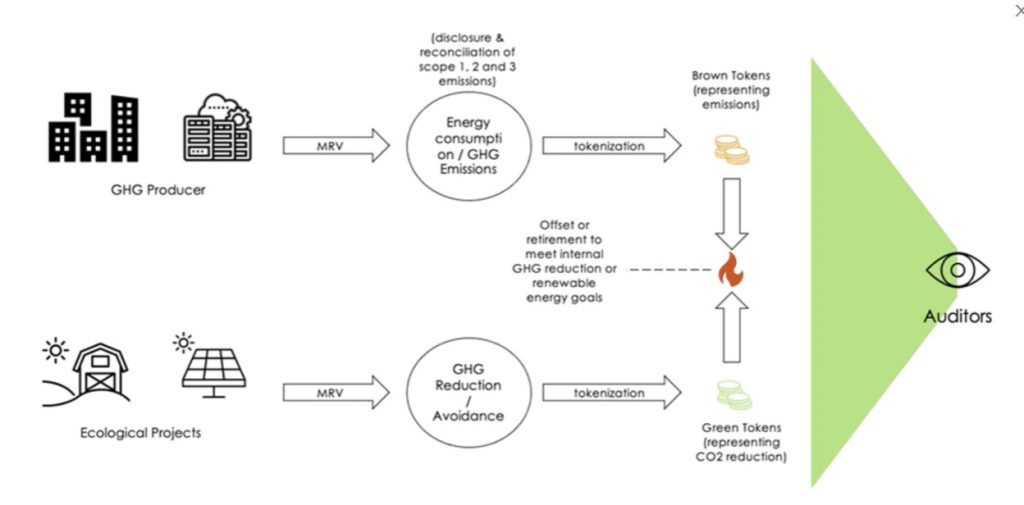

A typical supply-demand interaction is shown in the figure.

Carbon accounting is the upper branch of the process. Sensors, integrations, or manual inputs are used to determine emissions. On the Now Platform, organizations collect data and send it to the DLT, where it becomes immutable. Raw or aggregated dMRV data is linked to “brown tokens” (the ecological debt).

As a result of integrating the ServiceNow ESG Public Ledger with an entire supply chain, we will also be able to reconcile emissions with downstream suppliers and upstream customers to identify gaps, allowing granular control of emissions.

In the figure, the lower branch represents CO2 avoidance or reduction. “Green tokens” (ecological credits) are backed by dMRV data. The owner of these tokens can trade them over the counter or transfer them to a marketplace once they have been minted.

To reduce carbon emissions, companies can acquire green tokens and burn the same amount of both, verifying the retirement on the ledger.

All data is available on the DLT, so the entire process can be audited in real-time. A manual inspection can be performed by all parties, or automated and AI-based techniques are more effective.

We will discuss a specific asset category, Renewable Energy Credits, and how ServiceNow ESG Public Ledger makes them easier to manage.

A use case for RECs

Green energy RECs are tradable, non-tangible assets that represent one megawatt-hour of green energy. The difference between a carbon offset and a REC is that a carbon offset represents a reduction in greenhouse gas emissions. In contrast, a REC refers to energy produced from renewable sources, such as solar and wind power.

In some cases, RECs can be considered carbon offsets, although the two concepts are separate.

Since RECs are experiencing significant growth, they’re expected to grow even more by 2030. Transparency and effectiveness are issues they are experiencing. One of the most widely adopted standards for RECs is the International REC Standard or I-REC.

A frequent criticism of RECs is that they lack traceability of the actual projects, geographies, and parties involved.

Furthermore, buyers cannot verify the history of the REC. Scaling the entire system is challenging because it relies on the central control of the authorities. As a result, parties are exposed to errors, double counting, and greenwashing.

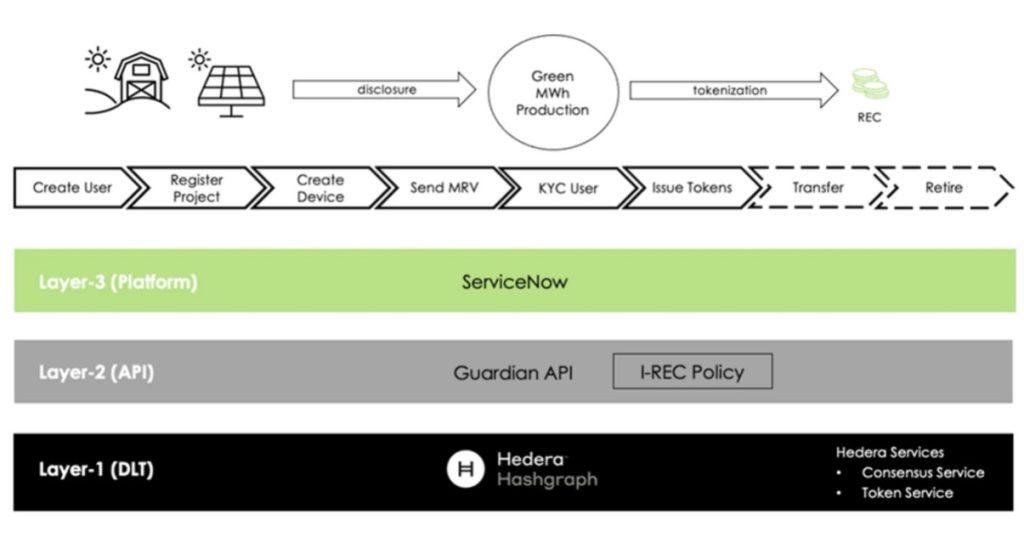

As shown in the figure, I-REC is built on the Now Platform. There are only two participants in this workflow: the I-REC Registry and Solar Inc.

As you can see in the live demo, the steps are (1) creating the project and device, (2) entering the dMRV data, (3) completing KYC, and finally (4) minting the RECs.

Our next article will cover the process of buying, selling, and retiring these tokens, which requires a first look at carbon accounting.

Hedera and ServiceNow Technology Stack

Onboarding and approvals for the ESG Public Ledger are managed by the Now Platform. In ServiceNow jargon, this is the Guardian spoke, which allows the creation of workflows and automation using configurable building blocks called activities, which are natively integrated into the Now Platform.

In addition to best-in-class identity management and tokenization libraries, the Guardian is a modular, open-source solution. With the Guardian, applications can provide a requirement-based tokenization implementation based on a Policy Workflow Engine (PWE) that uses the Hedera Consensus Service and Token Service. As a token chain of trust, Guardian makes the entire history of the ESG asset visible.

For the ServiceNow ESG Public Ledger, Hedera Hashgraph is Layer-1. The benefits of Hedera are numerous: governance, economics, and performance. Being carbon neutral is especially important. According to the Centre for Blockchain Technology (CBT) of the University College of London (UCL), Hedera is the greenest Proof-of-Stake (PoS) ledger. The Hedera network scores the highest in terms of sustainability, with 0.04 Watts per transaction, which is lower than all the other PoS networks, non-PoS networks such as Bitcoin, or non-DLT networks such as Visa.

Key Takeaways

Managing climate assets, liabilities, and verifiable data require an ESG Public Ledger. This worldwide ledger can be integrated directly into enterprise processes with ServiceNow and Hedera Guardian.

With the Now Platform, participants’ onboarding, token lifecycles, and approvals are managed, as well as DLT data visibility and analytics.

Third-party applications published on the Store (like Deloitte CarbonNow) and ServiceNow applications (part of Technology Excellence, Customer Experience, Employee Experience, or Operational Excellence) can provide data.

Data is collected and aggregated from internal and external sources by ServiceNow ESG Management. Integrations through IntegrationHub and Edge-to-Cloud are external sources.

The ESG Management and ESG Command Center applications across the Now Platform collect and aggregate data, which is then served to the Guardian by ServiceNow.

In the recording, ServiceNow manages Renewable Energy Credits (RECs) through a manual data collection and tokenization process. Virtually all ESG token policies, such as the GHG Protocol or Verra, use the same approach.

Via this site